missouri vendor no tax due certificate

Make sure both the FEIN and state EIN are included on the letter. If you need.

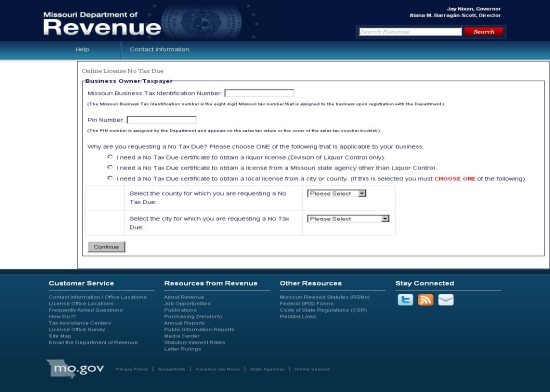

In order for the business owner or authorized representative to obtain a no tax due through the online system the business must.

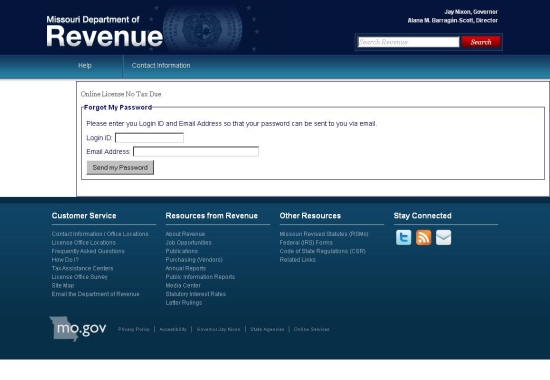

. Mail Fax Taxation Division. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. Current Vendor No Tax Due letter from the Missouri Department of Revenue.

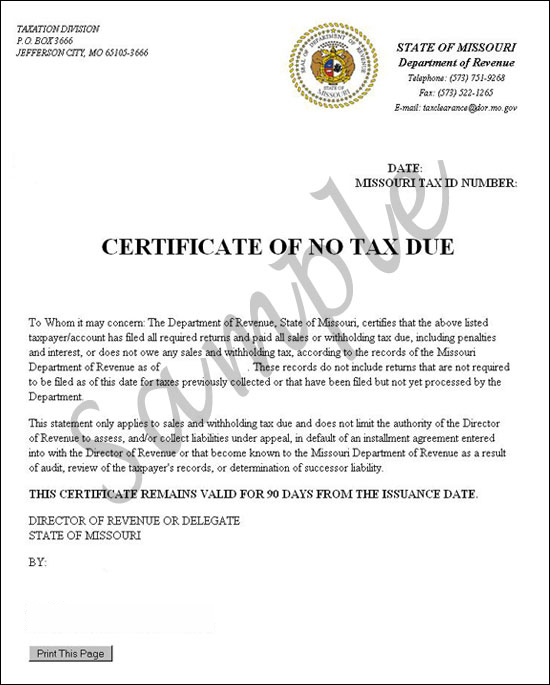

Missouri Certificate Of No Tax DueAlexius hospital corp 1 notice number 2001943924 missouri id 18977901 june 19 2018. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due. I require a sales or use tax Certificate of No Tax Due for the following.

The fax number is 573 522-1265. If a business license is not required submit a statement of explanation. All groups and messages.

Has a valid registration with the. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. Missouri vendor no tax due certificate.

Tax Clearance please fill out a Request for Tax Clearance Form 943. Once the form is completed and signed by a corporate officer. Notification from the Missouri Department of Revenue of the business entitys Missouri Employer Identification Number.

Cities counties and state agencies can verify whether a business is tax compliant before issuing or renewing a business license. Contact person Phone Number. Select all that apply.

If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. If not required to be submitted submit a statement of explanation. If the business is properly registered and does not owe any Missouri sales or withholding tax this site will allow you to print your own Certificate of No Tax Due which you can present to the local or state agency.

I require a sales or use tax Certificate of No Tax Due for the following. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. Receive this information Title.

A Certificate of No Tax Due is NOT sufficient. Information available at httpdormogovforms943pdf. No tax due please enter your moid and pin below in order to obtain a statement of no tax due.

Local license renewal records and online access request form 4379a request for information or audit of local sales and use tax records 4379 request for information of state agency license no tax due online access 4379b. Missouri Department of Revenue Tax Clearance Unit at 573 751-9268. Select all that apply.

If you have questions concerning reinstatements please contact the. If taxes are due depending on the payment history of the business a cashiers check or money order may be required for payment before a certificate of no tax due can be issued. A Vendor No Tax Due can be obtained by contacting.

A Certificate of No Tax Due is NOT sufficient. R Business License r Liquor License r Other if not listed _____ 4. R Business License r Liquor License r Other if not listed 4.

The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full. Have a valid registration with the Missouri. State law section 144083 RSMo requires businesses to demonstrate they are compliant with state sales and withholding tax laws before they can re.

A business may obtain a no tax due online if it. Reason For No Tax Due. A business that makes retail sales must obtain a statement from the Department of Revenue stating no tax is due for state withholding tax and state sales tax before a city county or state agency will issue or renew any licenses required for conducting business where goods are sold at retail.

How To Obtain A Certificate Of Vendor No Tax Due A Vendor No Tax Due certificate can be obtained from the Missouri Department of Revenue when a business pays all of its salesuse tax in full up to date does not have a sales tax delinquency or does not sell tangible personal property at retail in Missouri. Current Vendor No Tax Due letter from the Missouri Department of Revenue. Please click on the applicable box below to obtain a no tax due certificate or be directed to the MyTax Missouri Government Portal.

To obtain or renew a contract with the state of missouri. If you have questions concerning the tax clearance please contact the. A tax-compliant business will be able to print its Certificate of No Tax Due within minutes.

If you are requesting a No Tax Due use No Tax Due Request Form 5522.

Missouri Sales Tax Exemption Ebenezer Lutheran Church

Overcoming Tax Management Challenges Through Automation Within Dynamics 365 Business Central Video Encore Business Solutions

Business License Applications And Information City Of Belton

30 Blank Personal Financial Statement In 2020 Personal Financial Statement Financial Statement Statement Template

Pdf Common Structures Of Asset Backed Securities And Their Risks